The GCC construction market is projected to reach $2.7 trillion by 2033, growing steadily from its 2025 baseline due to massive infrastructure investment, housing demand, and sustainability initiatives.[?]

Market Outlook & Growth Drivers

The market itself reached $147.1 billion and is forecast to grow to $226.2 billion by 2033, reflecting a steady 4.9% CAGR. This growth will be fueled by ongoing investments in transport, energy, housing, and tourism projects across the region.

Additionally, each GCC country has its priorities and focus areas. Government strategies and foreign capital are shaping national priorities:

-

Saudi Arabia dominates the region, driven by mega-projects like NEOM and the Red Sea Project.

-

The UAE is focused on smart cities, green energy infrastructure, and luxury residential developments.

-

Qatar is capitalizing on tourism and logistics developments from its World Cup legacy projects.

Segment Performance

Residential projects are driving growth thanks to a rising population and increased housing demand, while transport and renewable energy infrastructure are accelerating. Industrial and commercial investments, including logistics hubs and smart districts, are also on the rise.

Key trends shaping the market in the GCC:

-

Sustainable infrastructure & green building. The region is rapidly adopting eco-friendly designs, renewable energy plants, and energy‑efficient construction practices.

-

Smart cities & digital tech. Projects increasingly rely on BIM, drones, and IoT‑enabled site operations to improve planning and execution.

-

Cost & workforce optimization. Digital tools and strategic partnerships are helping offset rising material and labor costs while improving efficiency.

-

Digital сonstruction technologies. BIM, AI, and IoT are opening opportunities for tech providers and contractors willing to invest in innovation.

-

Modular & prefabricated builds. Faster delivery and cost savings are driving the growing demand for modular solutions.

-

Public‑private partnerships (PPP) expansion. Governments and private investors are collaborating more often on infrastructure and social projects, sharing risk and accelerating delivery.

-

Talent development. The rising need for skilled labor and local expertise is increasing investment in training and workforce development.

ERP that saves your money

Adopt FirstBit ERP to cut costs, boost ROI, and effectively plan future cash flows

Request a demo

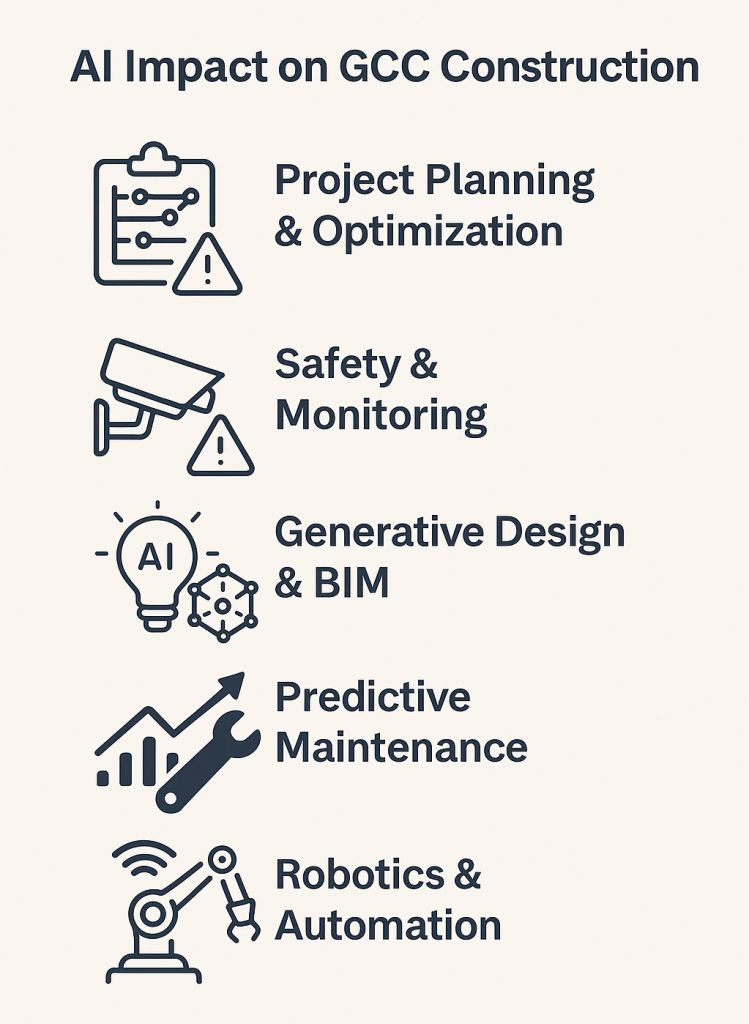

AI Impact on GCC Construction

With evolving economic goals and new technologies, the Middle East region offers multiple AI opportunities.

Here are some of the most promising areas where growth and AI integration are expected:

-

Project planning & optimization. AI algorithms improve schedule accuracy and resource allocation.

-

Safety & monitoring. AI-powered cameras and IoT devices detect hazards and predict risks in real time.

-

Generative design & BIM. AI integrates with BIM for faster design iterations and clash detection.

-

Predictive maintenance. Helps avoid downtime by forecasting equipment failures.

-

Robotics & automation. From drone site surveys to autonomous machinery, AI enhances precision and addresses labor shortages.

This outlook brings both opportunities and challenges for stakeholders in the construction industry. Companies that embrace sustainability and digital technologies will be better positioned to secure projects and achieve long-term growth.

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.