In fact, contractors worldwide lost an estimated $1.8 trillion in 2020, with avoidable rework alone costing some companies up to $7.1 million[?]. A significant share of these losses stems from rigid contracts that fail to adapt when project realities shift.

What Is a Cost-Plus Contract in Construction?

Example of a cost-plus percentage of cost contract in construction

During a major villa renovation project, the contractor and the customer decided to use a cost-plus percentage of cost contract, given the unpredictable nature of certain costs involved in luxury fittings and custom architectural features.

Midway through the project, the decision was made to add a high-end indoor pool and marble statuary, items whose prices fluctuate significantly based on market availability. The final bill from the contractor included AED 100,000 for the pool installation, AED 75,000 for the marble, and AED 45,000 for additional structural changes, totaling AED 220,000.

With a 20% markup for overhead and labor costs, the final payment due was AED 264,000. The labor, calculated at AED 500 per hour for 300 hours, totalled AED 150,000, leaving a remaining AED 36,000 to cover the contractor’s operational costs and provide a margin of profit.

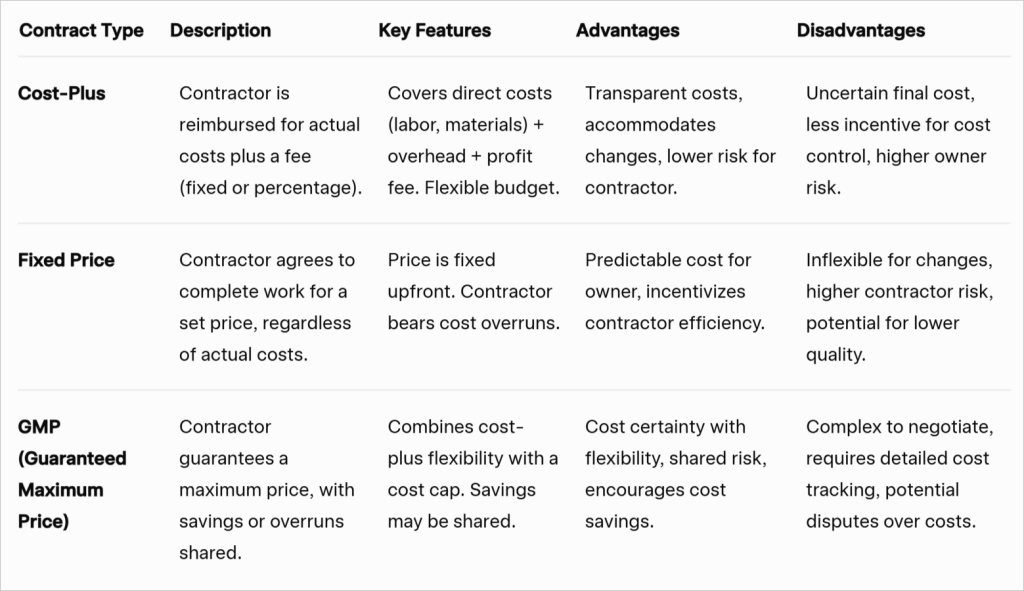

How is it Different from Fixed-Price and GMP Contracts?

However, when clients prefer fixed-price contracts for complex projects, even though they are unsuitable, contractors face a dilemma. They must protect themselves from financial risks, such as unforeseen cost escalations or scope changes, which cost-plus contracts naturally handle. This often results in higher initial bids, frequent change orders, and internal adjustments to manage increased uncertainty, which highlights why cost-plus contracts are better suited for truly complex work.[?]

Key Components of a Cost-Plus Agreement

-

Direct cost. Labor (wages and benefits for workers), materials (supplies and equipment), and subcontracts (payments to specialized subcontractors).

-

Indirect costs. Overheads such as office rent, utilities, and administrative salaries support the contractor’s operations.

-

Fee. The contractor’s profit, which can be a fixed sum, a percentage of total costs, or tied to performance incentives.

-

Contingencies. Allowances for unexpected expenses, if specified, to cover unforeseen challenges.

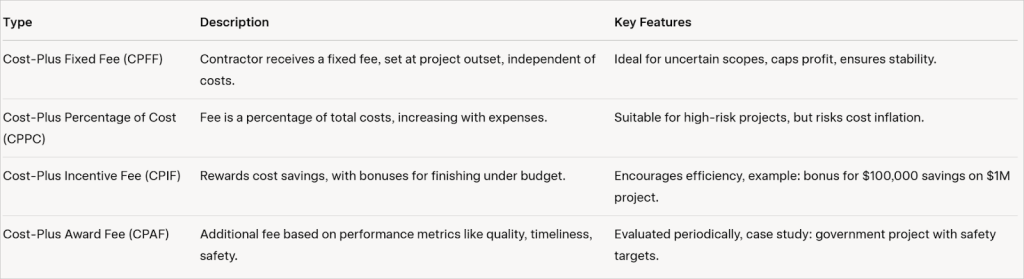

Types of Cost-Plus Contracts You Can Use

-

CPFF. The fixed fee is determined based on estimated costs and desired profit, ideal for projects needing flexibility without encouraging cost inflation.

-

CPPC. The fee calculation means profit rises with costs, suitable for high-risk projects but potentially discouraging cost control, as noted in construction analyses.

-

CPIF. The incentive mechanism rewards contractors for cost efficiency, with examples like earning a $50,000 bonus for completing a $1 million project at $900,000, fostering cost management.

-

CPAF. Award fees are determined based on performance criteria, with a case study in a government building project where quarterly fees were awarded for exceeding safety and schedule targets, boosting compensation while ensuring high standards.

Operate confidently in the UAE regulatory landscape

Advantages and Disadvantages

-

Flexibility. Allows for scope changes without renegotiating the entire contract, ideal for projects with evolving requirements, such as unexpected site conditions or mid-project design changes, as noted in recent construction blogs.

-

Transparency. Requires detailed documentation of all costs, providing clients with clear visibility into labor, materials, subcontractor invoices, and equipment rentals, fostering trust.

-

Reduced risk for contractors. Contractors are reimbursed for actual costs, lowering the risk of underestimating expenses and encouraging a collaborative relationship, as highlighted in project management guides.

-

Encourages collaboration. Shared risk fosters a partnership approach, prioritizing project success over cost-cutting, especially in projects requiring trust, as discussed in inventory management resources.

-

Suitable for complex projects. Ideal for scenarios like historical renovations or infrastructure upgrades where the full scope is hard to define upfront, reducing initial estimation errors, as exemplified in recent project examples.

-

Potential for higher costs. Without a cost cap, total project expenses can escalate, which may concern clients, especially if contractors lack incentives to control costs, as noted in contract management resources.

-

Requires detailed oversight. Clients must monitor the project closely to ensure costs are justified, increasing administrative workload, as emphasized in construction cost analyses.

-

Risk of delays. Contractors may have less incentive to finish quickly since they are paid based on costs rather than completion, potentially extending timelines, as discussed in building contract guides.

-

Administrative burden. Both parties must maintain meticulous records, which can be time-consuming and costly, especially for large projects, as noted in construction management blogs.

-

Possibility of disputes. Disagreements can arise over what constitutes a reimbursable expense, particularly regarding indirect costs or overhead, potentially leading to legal challenges, as highlighted in recent contract analyses.

Mitigation Strategies

-

Set a GMP. Capping total costs while retaining flexibility, balancing client risk and contractor adaptability, as suggested in construction management resources.

-

Use incentive fees. Encourage timely completion and cost control through bonuses for efficiency, aligning contractor and client interests, as discussed in contract management guides.

-

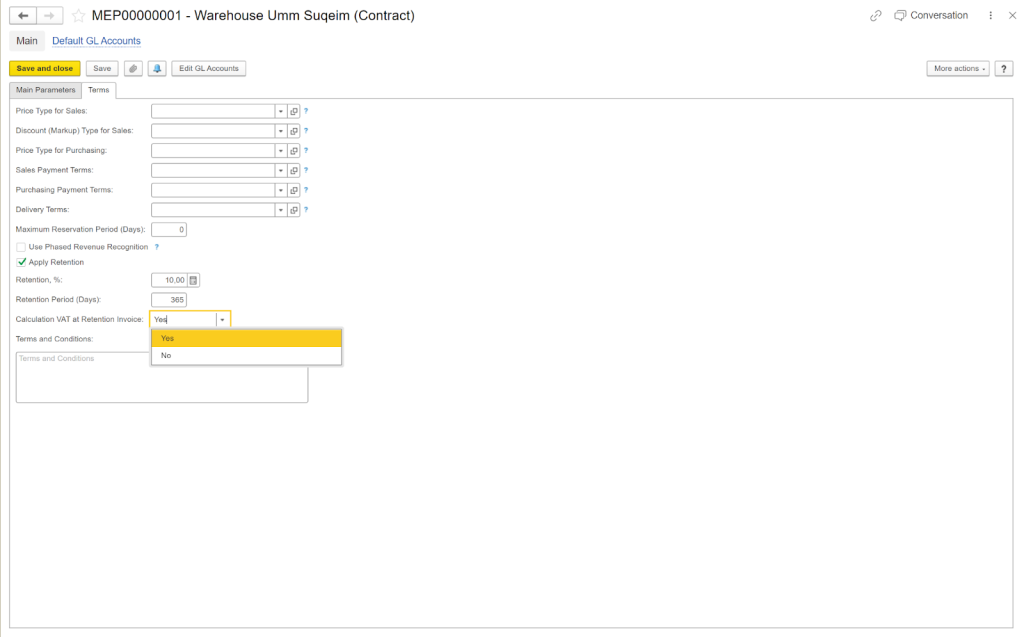

Leverage software. Tools like FirstBit ERP can streamline cost tracking and documentation, reducing administrative burdens and ensuring transparency, as noted in ERP solution reviews.

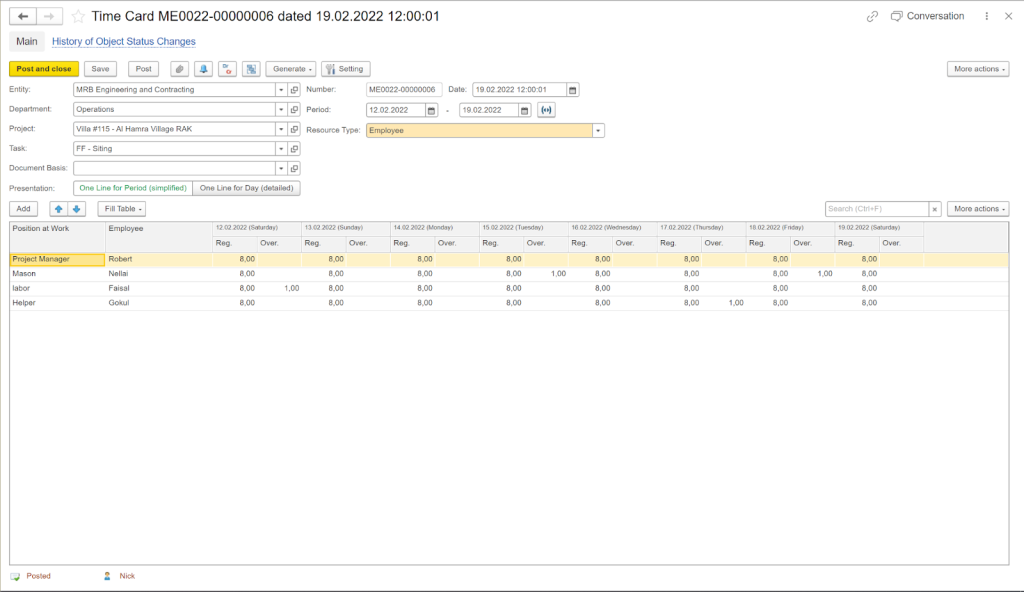

How FirstBit ERP Supports Cost-Plus Construction Projects

Final Thoughts

Manage contracts efficiently with FirstBit

See FirstBit ERP solutions in action

After the demo you will get a quotation for your company.