In the construction industry, financial clarity can feel like a moving target — especially when you're dealing with large-scale projects that are still underway. Costs are pouring in from all directions — materials, labor, subcontractors, permits — but the work isn't finished.

So how do you reflect these ongoing expenses in your financial records without throwing off your entire balance sheet? This is exactly where Construction In Progress (CIP) accounting comes into play.

Without a clear CIP process in place, project expenses often get misclassified, lost in general ledgers, or spread across unrelated cost centers. This not only creates confusion during monthly or quarterly closings, but also makes it difficult to budget accurately, forecast future cash needs, or provide stakeholders with reliable financial updates.

Even worse, poor visibility into these costs can lead to compliance issues if your records don’t align with standards like GAAP or IFRS — raising red flags during audits and putting your credibility at risk.

This is where many finance and operations teams begin searching for answers, looking for a smarter way to manage costs that haven’t yet turned into finished assets. In this guide, we’ll break down why CIP accounting matters, what makes it challenging, and how tools like FirstBit ERP can help construction businesses take control of in-progress costs and financial reporting before projects are even completed.

Understanding the Concept of CIP

Construction In Progress (CIP) is an accounting term used to represent the costs associated with building or developing a long-term asset that is not yet ready for use.

These are assets still under construction. Think of a half-finished office building, a new warehouse, or an infrastructure project like a highway or airport terminal. Until the project is completed, all the associated costs, materials, labor, equipment, design fees, permitting, and more are held in a separate account on the balance sheet called the CIP account.

A CIP account is classified as a non-depreciable fixed asset under the broader category of Property, Plant, and Equipment (PP&E).

The reason it doesn’t depreciate is simple: depreciation only applies to assets that are in service and providing economic benefit. Once the asset is completed and put into use, the accumulated costs in the CIP account are transferred to a fixed asset account, and depreciation begins from that point forward.

For example, if a construction company is building a new regional office, all costs — architectural planning, excavation, material purchases, and contractor payments — would be recorded under CIP. When the building is completed and operational, the total cost is reclassified as a building (or property), and depreciation starts based on the expected useful life.

This process is not just a formality. It ensures that expenses related to long-term assets are not prematurely recognized on the income statement, which would distort financial performance and violate accrual accounting principles.

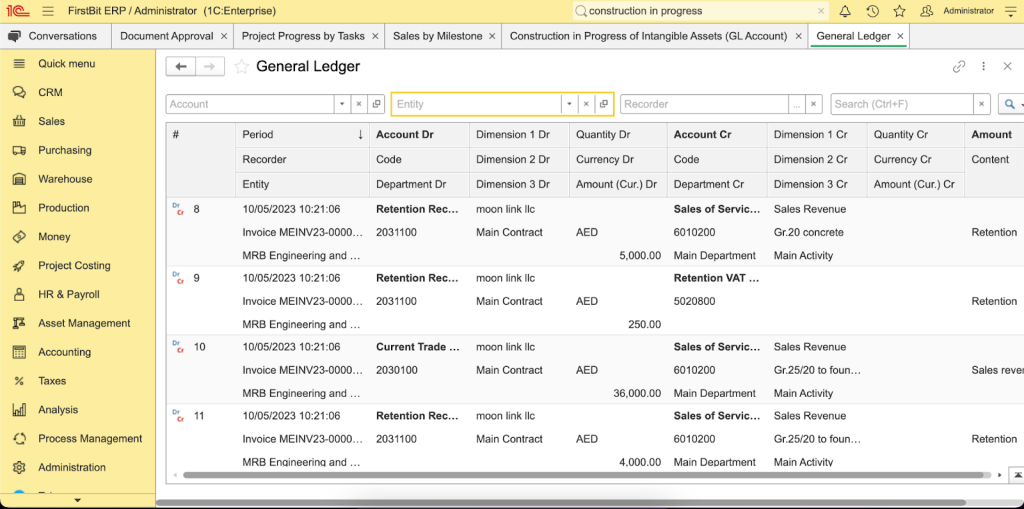

General ledger accounting in FirstBit ERP for construction in progress

Importance of CIP in Financial Reporting

CIP accounting plays a vital role in delivering accurate, transparent, and compliant financial reports, especially in the construction and real estate industries where projects often span several months or even years.

Without CIP accounting, companies would have to expense construction costs as they occur, even though the asset hasn’t started generating value. This would lead to a mismatch in timing between cost and benefit, misrepresenting the company’s profitability and return on investment.

Here’s why it matters:

-

Better financial visibility. CIP separates in-progress

project costs from regular operational expenses, giving a clearer picture of ongoing investments.

-

Improved budgeting and forecasting. By tracking CIP, finance teams can better manage cash flow, predict capital needs, and identify potential cost overruns early.

-

Compliance with standards. Accounting frameworks like GAAP and IFRS require that companies capitalize construction costs during development and only begin depreciation once the asset is complete.

-

Investor and stakeholder confidence. Accurate CIP tracking builds trust with investors, lenders, and auditors by showing a disciplined approach to capital project management.

-

Tax and audit readiness. CIP records provide detailed support for cost basis, which is crucial during audits and for calculating depreciation deductions once the asset is in service.

Ultimately, CIP isn’t just about accounting — it's about aligning your books with reality. And in the construction industry, where delays, change orders, and rising material costs are common, maintaining that alignment is key to financial health.

Key Components of CIP Accounting

Understanding what goes into CIP accounting is essential for maintaining financial accuracy throughout a project’s lifecycle. This section breaks down the two most critical components: capitalization of costs and the tracking and reporting of CIP assets.

1. Capitalization of Costs

One of the core principles of CIP accounting is determining which costs should be capitalized — that is, recorded as part of the asset’s value rather than expensed immediately. According to both GAAP and IFRS, only costs that are directly attributable to the construction or acquisition of a long-term asset can be capitalized.

These typically include direct costs and certain indirect costs, if they are specifically tied to the project.

Direct costs:

Certain indirect costs:

Costs that should not be capitalized include general administrative expenses, idle labor, training costs, and post-completion maintenance. These are typically expensed as incurred.

It’s also important to note that capitalization ends when the asset is “substantially complete” and ready for its intended use, even if it hasn’t yet been officially placed in service.

Misclassifying costs, especially capitalizing expenses that should be recorded immediately, can lead to serious audit findings and restatements of financial statements.

2. Tracking and Reporting of CIP

Capitalizing costs is only one part of the puzzle. The other is accurately tracking and reporting those costs throughout the life of the project. This involves setting up internal systems that monitor how money is being spent, how much progress has been made, and whether the investment is aligned with the approved budget.

Key practices include:

-

Creating dedicated project codes or cost centers for each asset under construction.

-

Using progress-based tracking — recording not just financial entries but also physical milestones (e.g., 30% completion of foundation, 100% installation of MEP).

-

Maintaining detailed supporting documentation, invoices, contracts, purchase orders, time logs, and change orders, to support all entries in the CIP ledger.

-

Regular reconciliations between the CIP account, actual costs incurred, and project schedules to avoid overspending or underreporting.

A report by FMI and Autodesk found that bad project data and miscommunication account for $88.69 billion in avoidable rework costs globally each year, much of which stems from inadequate tracking systems, including CIP processes.[?]

Prevent cost overruns

Register expenses in FirstBit ERP

Request a demo

Challenges and Considerations in CIP Accounting

While Construction In Progress accounting provides essential clarity and control over long-term project costs, it’s far from straightforward in practice. Many construction firms, especially those growing quickly or handling multiple projects at once, struggle with properly managing CIP accounts. Let’s look at the key challenges and critical considerations involved.

1. Misclassification of Costs

One of the most frequent mistakes in CIP accounting is misclassifying costs, either by capitalizing expenses that should have been expensed or, conversely, expensing costs that should have been capitalized into the CIP account.

For example, general administrative salaries or marketing expenses related to a new development often get incorrectly included in CIP, inflating asset values and violating accounting standards.

This can lead to distorted financial statements, improper depreciation calculations, and compliance issues during audits. It’s especially difficult when there are multiple stakeholders involved, like project managers, procurement officers, and finance teams, who may interpret cost categories differently.

The solution:

-

Implement clear cost classification guidelines based on GAAP or IFRS. Everyone handling project costs, from field engineers to finance, should know what qualifies as a capital expense.

-

Use accounting software with job costing functionality, which allows you to tag and categorize every transaction at the source.

-

Train staff regularly on cost classification rules and common examples of misclassified expenses to reduce human error.

2. Incomplete or Outdated CIP Records

Construction projects move fast — costs accrue daily, invoices pile up, and project changes occur frequently. When CIP records are updated manually or infrequently, finance teams end up working with outdated information. This causes issues with month-end closing, delays in budget reviews, and can mislead stakeholders about the true status of a project.

Delayed or missing data also makes it difficult to know when a project is ready to be moved from CIP to fixed assets, which affects depreciation schedules and tax reporting.

The solution:

-

Automate data capture by using integrated

construction ERP systems like FirstBit that sync with procurement, timesheets, and vendor payments.

-

Set up a monthly reconciliation process between CIP accounts and actual expenditures to catch discrepancies early.

-

Centralize all supporting documentation, such as invoices, purchase orders, and contracts, so it’s easily accessible and auditable.

3. Disconnected Field Progress and Financial Tracking

There’s often a disconnect between what’s happening on the construction site and what’s showing up in the books. Field teams report milestones like "foundation complete" or "70% framing done," but finance teams are tracking invoices, not progress. This misalignment leads to inaccurate work-in-progress (WIP) reports, unexpected cost overruns, and delayed reclassification of assets.

Without tying physical progress to financial records, it's also difficult to know if the project is over- or under-performing against budget.

The solution:

-

Use integrated software that links construction progress with financial tracking, such as FirstBit’s Project Progress Report tool, which aligns cost data with site milestones.

-

Standardize reporting formats between project managers and accountants, so everyone speaks the same language.

-

Schedule regular coordination meetings between the finance team and site managers to update project status and expected cost-to-completion figures.

4. Revenue Recognition Complexity

In long-term construction projects, recognizing revenue appropriately — especially when using the percentage-of-completion method — can be a complex process. Revenue tied to incomplete work may be overstated or understated depending on how well costs and progress are tracked. Incorrect recognition impacts income statements and may cause a mismatch between reported earnings and actual cash flow.

This is even more complicated under ASC 606 or IFRS 15, where performance obligations must be carefully evaluated, and revenue can only be recognized when certain conditions are met.

The solution:

-

Work closely with your accounting advisors to determine the correct revenue recognition method for each contract type.

-

Ensure progress billing and milestone tracking is tightly integrated with your accounting system, so revenue entries reflect actual work completed.

-

Keep thorough documentation for performance obligations, contract terms, and change orders to support revenue recognition decisions.

5. Cash Flow Mismatch Due to Delayed Payments

Construction companies often incur substantial costs months before they receive any payments from clients. While those costs build up in the CIP account, delayed cash inflow creates a strain on working capital and liquidity. If not monitored, this mismatch can stall projects or force companies to seek emergency financing at unfavorable rates.

The solution:

-

Adopt progress billing models, so you can invoice clients as project milestones are completed, rather than waiting until the end of a phase.

-

Use ERP tools to forecast cash flow based on CIP data and expected payments.

-

Maintain an emergency reserve or line of credit to cover periods of negative cash flow without jeopardizing project timelines.

Compliance with Accounting Standards

CIP accounting isn’t just a best practice, it’s also a requirement under most accounting frameworks.

Failing to follow these principles can lead to misstatements in financial statements, investor mistrust, and problems during external audits.

If you’re operating in a regulated environment like government-funded projects or public companies, CIP misreporting can trigger fines or investigation.

Keep every project on budget

Request a demo

Use of Specialized Software

Manual CIP accounting using spreadsheets and disconnected systems just doesn’t cut it anymore, especially when managing complex, multi-phase projects. That’s where specialized construction accounting software becomes a game-changer.

According to McKinsey & Company, adopting digital technologies in construction could increase productivity by up to 15% and reduce costs by as much as 6%, thanks to improved visibility, better decision-making, and streamlined workflows.[?]

Solutions like FirstBit ERP allow businesses to:

-

Automatically track and allocate costs to specific CIP accounts

-

Monitor actual vs. budgeted expenditures in real time

-

Align accounting data with construction progress (e.g., site completion percentages)

-

Generate audit-ready reports with a click

By integrating financial data with project timelines and procurement flows, software not only improves accuracy but also helps companies avoid overspending, reduce reporting delays, and strengthen compliance.

How FirstBit Aids in CIP Accounting

Construction companies often face a critical gap between field activity and back-office accounting. FirstBit ERP bridges that gap by offering a fully integrated system designed specifically for the construction industry, including advanced tools for managing Construction In Progress (CIP) accounting.

Here’s how FirstBit helps streamline CIP tracking and reporting.

1. Automated Cost Allocation

FirstBit automatically captures all project-related expenses — materials, labor, subcontractor payments — and allocates them to the appropriate CIP account in real time. No more manual entries or tracking down spreadsheets across departments.

2. Real-Time Project Progress Reporting

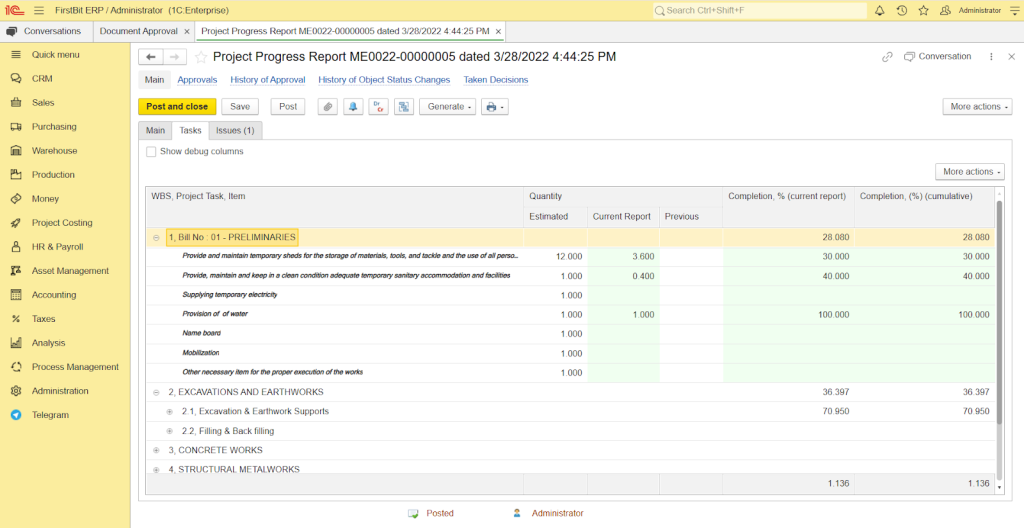

With FirstBit’s

Project Progress Report, you can easily align financial data with physical progress on-site. This gives both project managers and finance teams a unified view of what’s been completed and what remains, reducing disputes and improving cost-to-completion forecasts.

Project progress report in FirstBit ERP

3. Budget Control and Forecasting

You can track actual spending vs. budget in real time and receive alerts when thresholds are exceeded. This helps identify cost overruns early, improving control over capital expenditure and reducing the risk of mid-project surprises.

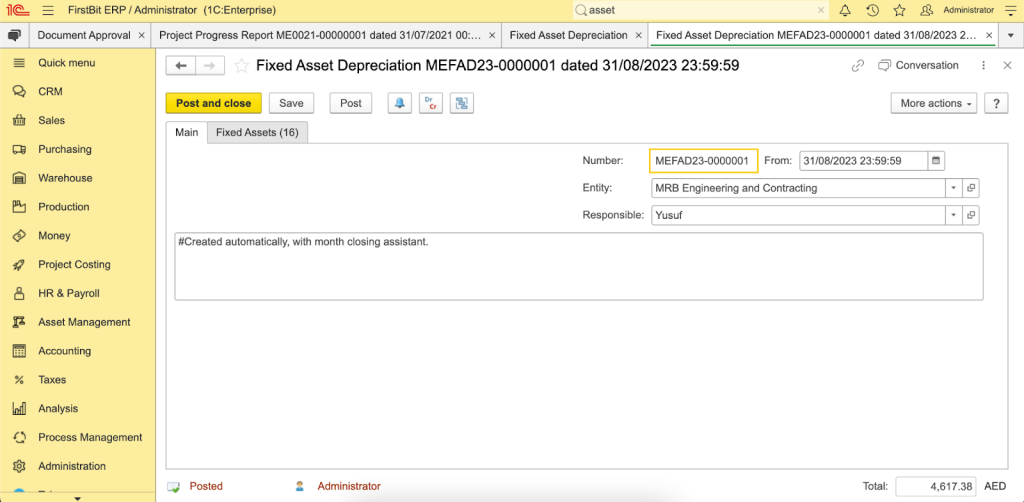

4. Streamlined Asset Capitalization

Once a project is complete, FirstBit allows for smooth reclassification from CIP to fixed assets. The system automatically transfers the accumulated costs and begins applying depreciation based on the asset’s useful life, eliminating errors and delays during asset activation.

Fixed asset depreciation in FirstBit ERP

5. Compliance and Audit Readiness

FirstBit helps you stay audit-ready with clear audit trails, documented cost classifications, and automated reports that align with IFRS standards. You can quickly generate detailed breakdowns of all costs held under CIP at any point in time.

Get paid faster and on time

Automate invoice creation by milestones with FirstBit

Request a demo

Key Takeaways

-

Construction In Progress (CIP) accounting is essential for accurately capturing the costs of building long-term assets that aren’t yet operational.

-

Common challenges include cost misclassification, outdated records, disconnected field and financial tracking, revenue recognition issues, and lack of specialized tools.

-

Addressing these challenges requires clear internal processes, cross-functional alignment, and modern software tools tailored to construction workflows.

-

FirstBit ERP provides automated cost tracking, integrated progress reporting, and compliance support to make CIP accounting simpler, faster, and more accurate.

Frequently Asked Questions About Construction In Progress Accounting

What is considered a Construction In Progress asset?

A CIP asset is a long-term asset under construction that is not yet ready for use. Examples include office buildings, production facilities, roads, or any infrastructure being built. All direct construction costs are capitalized under this account until the asset is complete.

When should costs stop being capitalized into CIP?

Costs should stop being capitalized when the asset is substantially complete and ready for its intended use. At this point, the asset is transferred out of CIP and begins depreciation.

Can operating costs be included in CIP?

No. General administrative costs, overhead unrelated to construction, and maintenance or training expenses should not be capitalized into CIP. Only direct or attributable costs are eligible under accounting standards.

How can CIP accounting improve financial decision-making?

Accurate CIP accounting helps companies track capital expenditure more effectively, monitor budget adherence, and forecast future cash needs. It also ensures that costs align with actual progress, which helps leaders make informed decisions about project financing, phasing, or scaling.

What are the risks of poor CIP accounting?

Inaccurate CIP accounting can lead to misstated financial statements, delayed asset capitalization, budget overruns, audit issues, and regulatory non-compliance. It can also erode investor confidence and obscure a company’s true financial health.

Get paid faster and on time

Request a demo

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles by providing practical content.